42 calculate zero coupon bond price

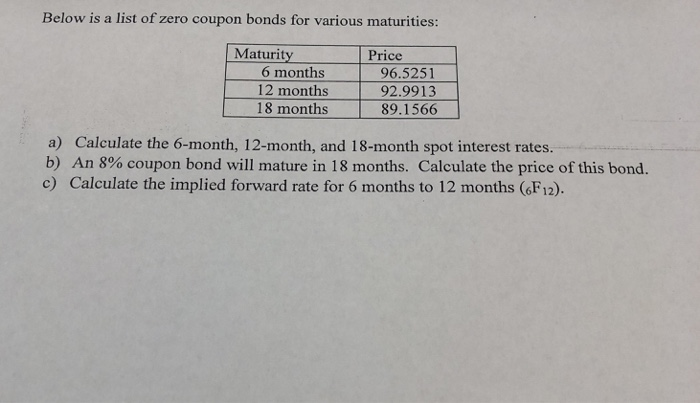

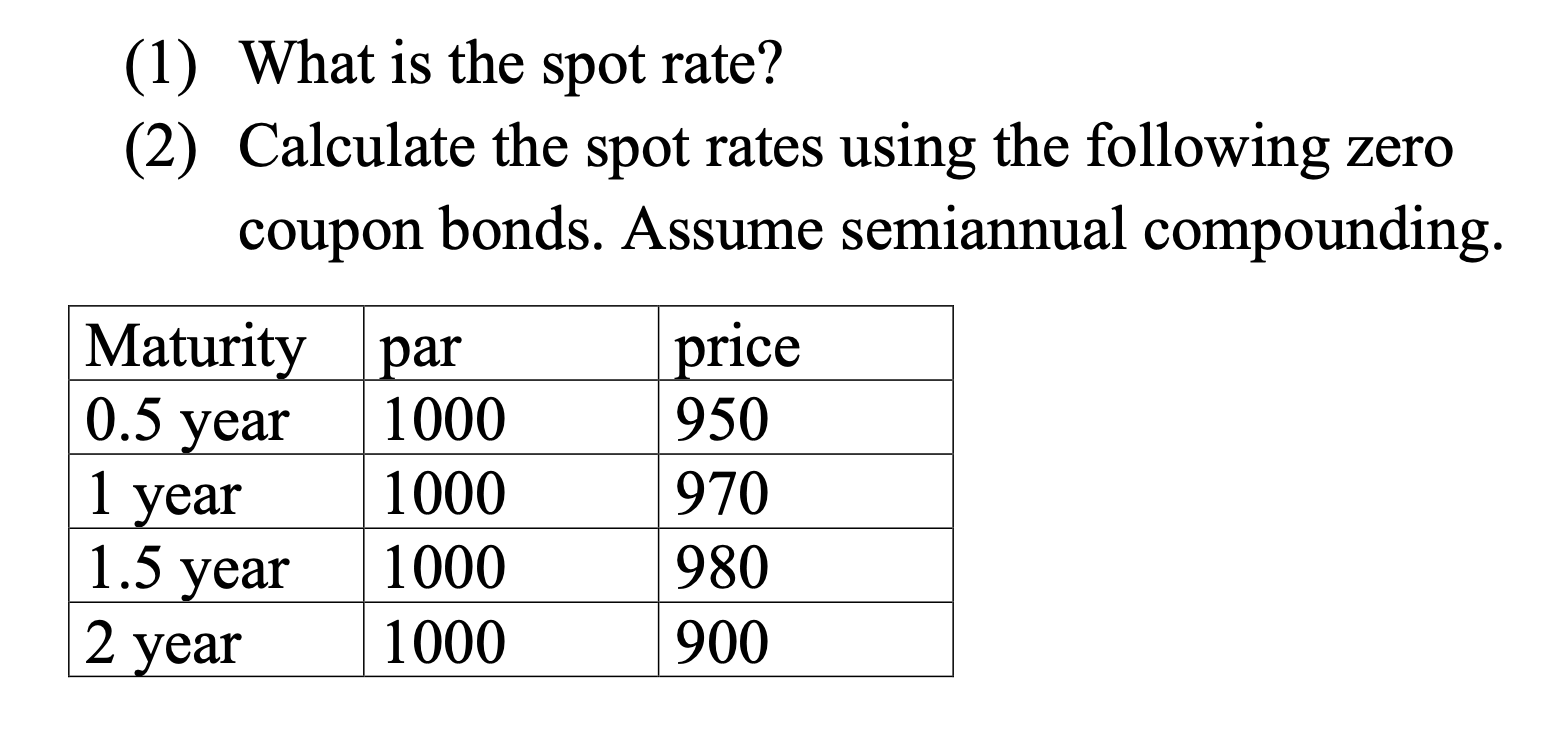

How to calculate bond price in Excel? - ExtendOffice Calculate price of a zero coupon bond in Excel. For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Before the maturity date, the bondholder cannot get any coupon as below screenshot shown. You can calculate the price of this zero coupon bond as follows: Bond Pricing - Formula, How to Calculate a Bond's Price The price of a bond is usually found by: P (T0) = [PMT (T1) / (1 + r)^1] + [PMT (T2) / (1 + r)^2] … [ (PMT (Tn) + FV) / (1 + r)^n] Where: P (T0) = Price at Time 0 PMT (Tn) = Coupon Payment at Time N FV = Future Value, Par Value, Principal Value R = Yield to Maturity, Market Interest Rates N = Number of Periods Bond Pricing: Main Characteristics

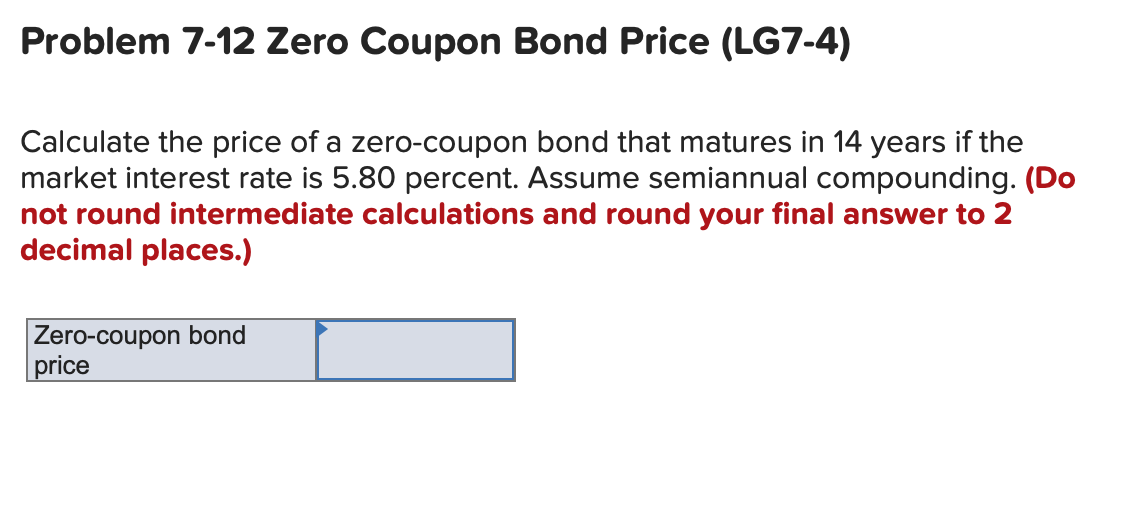

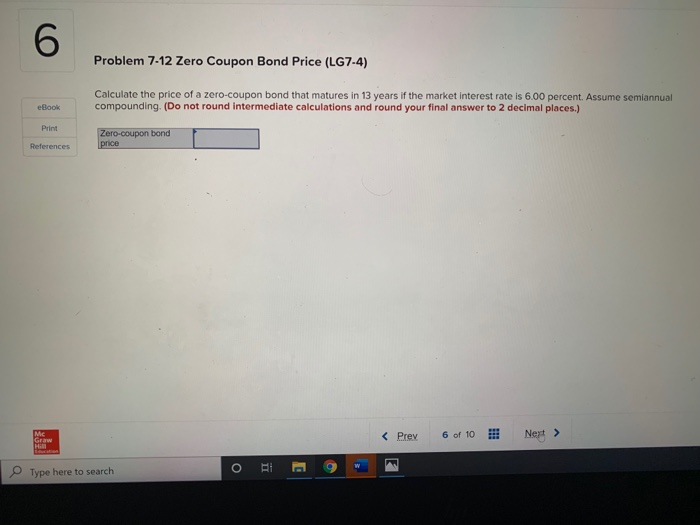

Solved Calculate the price of a zero-coupon bond that | Chegg.com Expert Answer. 100% (3 ratings) 1) zero coupon bond price =1000/ (1 …. View the full answer. Transcribed image text: Calculate the price of a zero-coupon bond that matures in 13 years if the market interest rate is 6.15 percent. Assume semiannual compounding. (Do not round intermediate calculations and round your final answer to 2 decimal ...

Calculate zero coupon bond price

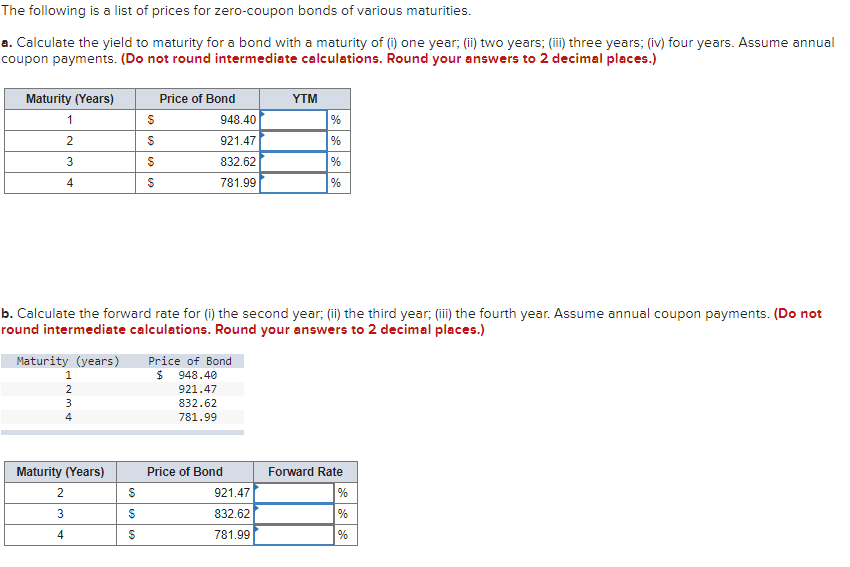

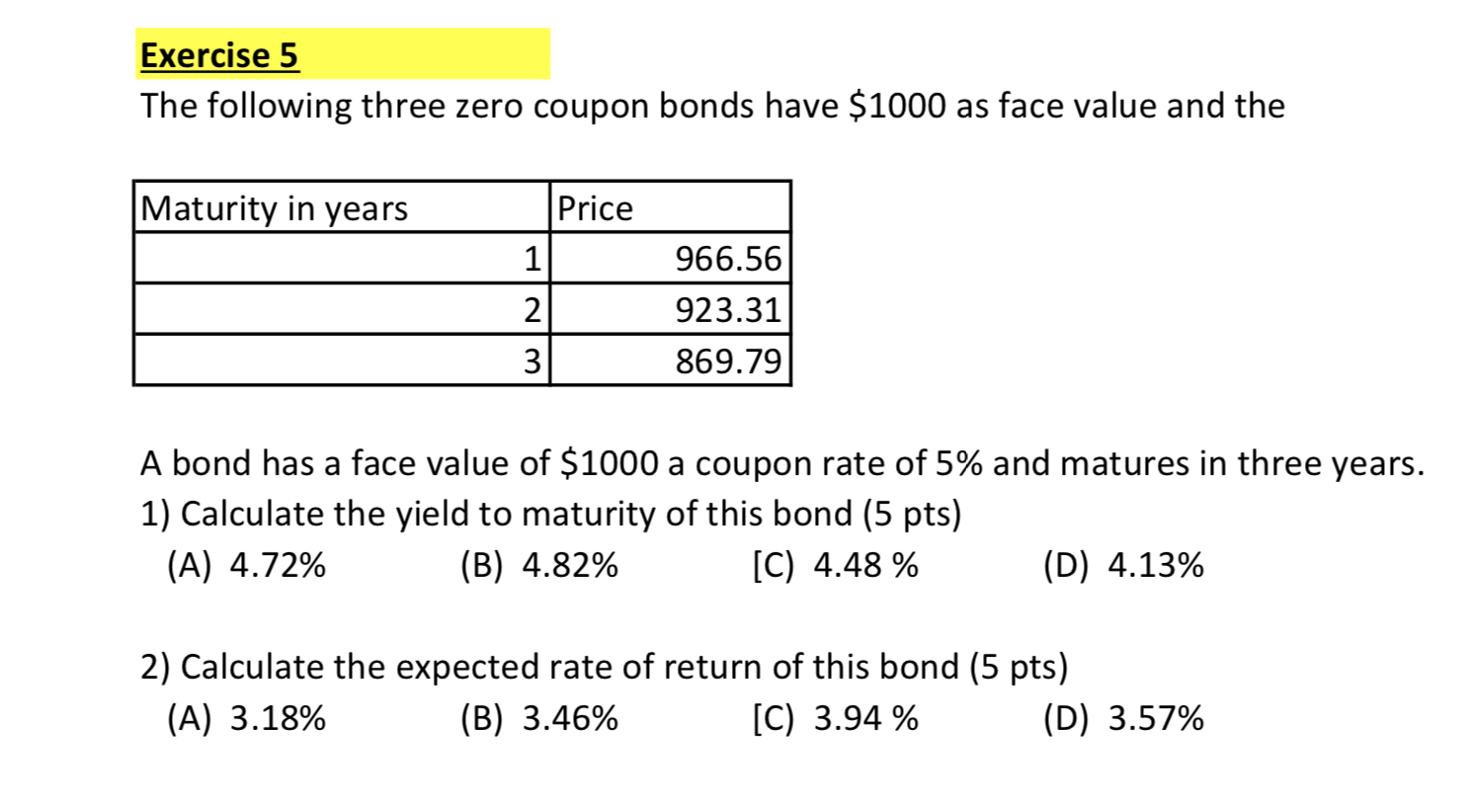

Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years. Coupon Bond Formula | How to Calculate the Price of Coupon Bond? = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate Zero-Coupon Bond: Definition, How It Works, and How To Calculate The price of a zero-coupon bond can be calculated as: Price = M ÷ (1 + r) n where: M = Maturity value or face value of the bond r = required rate of interest n = number of years until...

Calculate zero coupon bond price. Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value c = Coupon rate n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity Solved . Calculate the price of a zero-coupon bond that | Chegg.com Calculate the price of a zero-coupon bond that matures in 10 years if the market interest rate is7.1 percent. (Assume annual compounding and $1,000 par value.) This problem has been solved! You'll get a detailed solution from a subject matter expert that helps you learn core concepts. See Answer . Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ The zero coupon bond price formula is: \frac {P} { (1+r)^t} (1+ r)tP where: P: The par or face value of the zero coupon bond r: The interest rate of the bond t: The time to maturity of the bond Zero Coupon Bond Pricing Example Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000 How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as...

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. How to Calculate the Price of a Zero Coupon Bond Calculating Zero-Coupon Bond Price To figure the price you should pay for a zero-coupon bond, you'll follow these steps: Divide your required rate of return by 100 to convert it to a decimal. Add 1 to the required rate of return as a decimal. Raise the result to the power of the number of years until the bond matures. How to Calculate Bond Price in Excel (4 Simple Ways) Zero-coupon bond price means the coupon rate is 0%. Type the following formula in cell C11. = (C5/ (1 + (C8/C7))^ (C7*C6)) Press the ENTER key to display the zero-coupon bond price. Read More: How to Calculate Coupon Rate in Excel (3 Ideal Examples) Method 2: Calculating Bond Price Using Excel PV Function Zero Coupon Bond Value Calculator To use this online calculator for Zero Coupon Bond Value, enter Face Value (F), Rate of Return (%RoR) & Time to Maturity (T) and hit the calculate button. Here is how the Zero Coupon Bond Value calculation can be explained with given input values -> 675.5642 = 1000/ (1+4/100)^10.

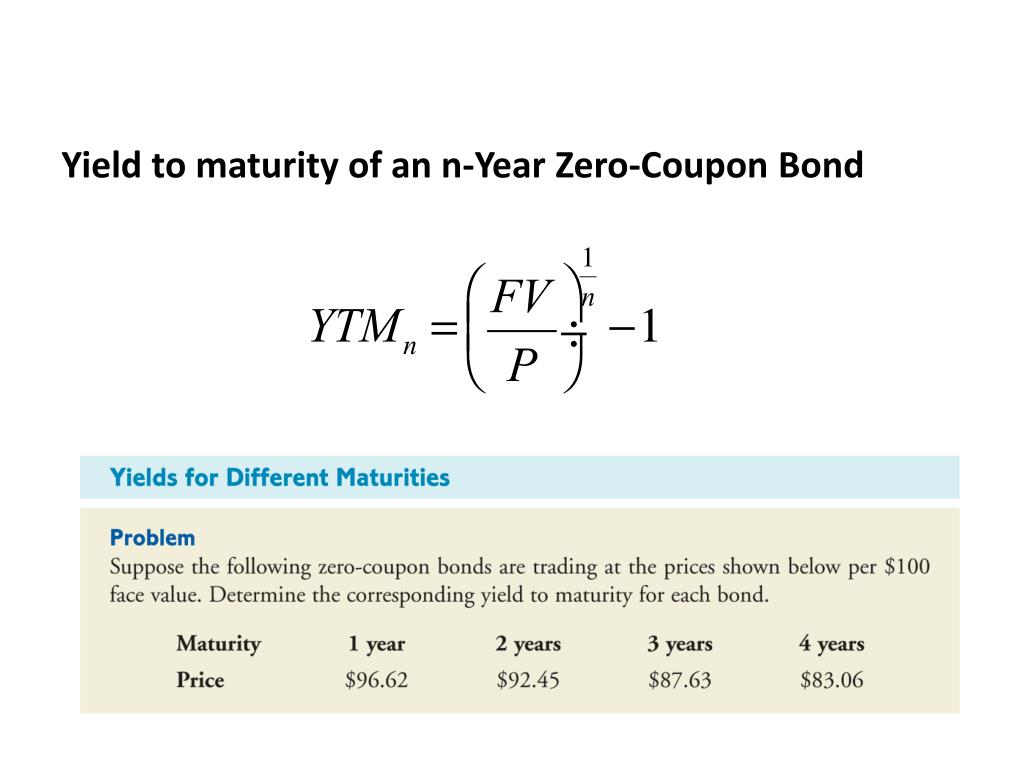

Zero-Coupon Bonds: Characteristics and Calculation - Wall Street Prep If the zero-coupon bond compounds semi-annually, the number of years until maturity must be multiplied by two to arrive at the total number of compounding periods (t). Formula Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods Zero Coupon Bond Calculator - Nerd Counter The particular formula that is used for calculating zero coupon bond price is given below: P (1+r)t Examples: Now come to a zero coupon bond example, if the face value is $2000 and the interest rate is 20%, we will calculate the price of a zero coupon bond that matures in 10 years. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) Zero Coupon Bond Calculator - MiniWebtool It is also called a discount bond or deep discount bond. Formula The zero-coupon bond value calculation formula is as follows: Zero coupon bond value = F / (1 + r) t Where: F = face value of bond r = rate or yield t = time to maturity

Zero Coupon Bond Calculator - Calculator App The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t. where ZCBV is the zero-coupon bond value; F is the face value of the bond; r is the yield/rate; t is the time to maturity; Zero Coupon Bond Definition. A zero-coupon bond is a security that does not pay interest but trades at a discount and renders a ...

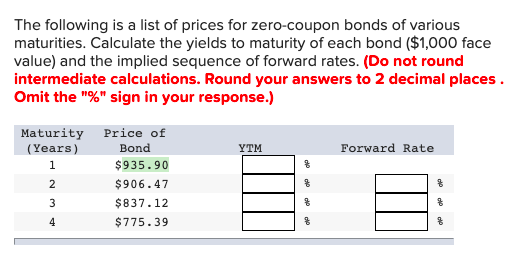

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Zero-Coupon Bond: Definition, How It Works, and How To Calculate The price of a zero-coupon bond can be calculated as: Price = M ÷ (1 + r) n where: M = Maturity value or face value of the bond r = required rate of interest n = number of years until...

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate

Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years.

:max_bytes(150000):strip_icc()/GettyImages-983195940-6d4c5099c3314718a5ba16c33205d071.jpg)

Post a Comment for "42 calculate zero coupon bond price"