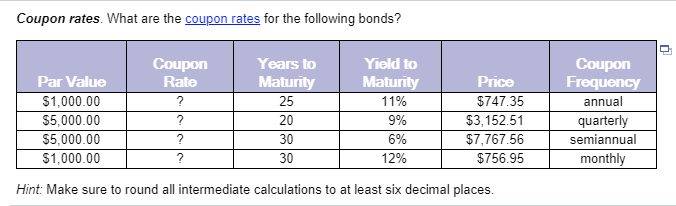

41 how to calculate coupon rate from yield

Current Yield Formula | Calculator (Examples with Excel Template) Current Yield of a Bond can be calculated using the formula given below Current Yield = Annual Coupon Payment / Current Market Price of Bond Current Yield = $60 / $1,010 Current Yield = 5.94% Therefore, the current yield of the bond is 5.94%. Current Yield Formula - Example #3 Nominal Yield - Overview, How To Calculate, Example 1. First, the semi-annual payments should be added to calculate the total amount of bond payments made during the year: $25 x 2 = $50. 2. Next, divide that total by the face value of the bond: $50 / $1,000 = 0.05. Stated in percentage terms, the bond shows a nominal annual yield of 5%.

How to Calculate Yield for a Callable Bond | The Motley Fool Finally, dividing by the average of the call price and the market value will convert this annual interest amount into a rate. Multiply the final result by 100 to convert to a percentage. An ...

How to calculate coupon rate from yield

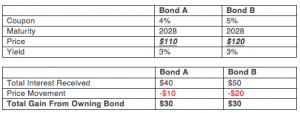

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ... Yield Calculation for a 10-Year Treasury Note | Sapling Current yield simply is the annual interest amount that a bond pays divided by the current price of the bond. For example, if you buy a bond with a $1,000 face value and an interest rate -- also known as the coupon rate -- of three percent, you'll earn $30 per year in interest. Coupon vs Yield | Top 5 Differences (with Infographics) The way the coupon rate is calculated is by dividing the annual coupon payment by the face value of the bond. In this case, the coupon rate for the bond will be $40/$1000, which is a 4% annual rate. It can be paid quarterly, semi-annually, or yearly depending on the bond.

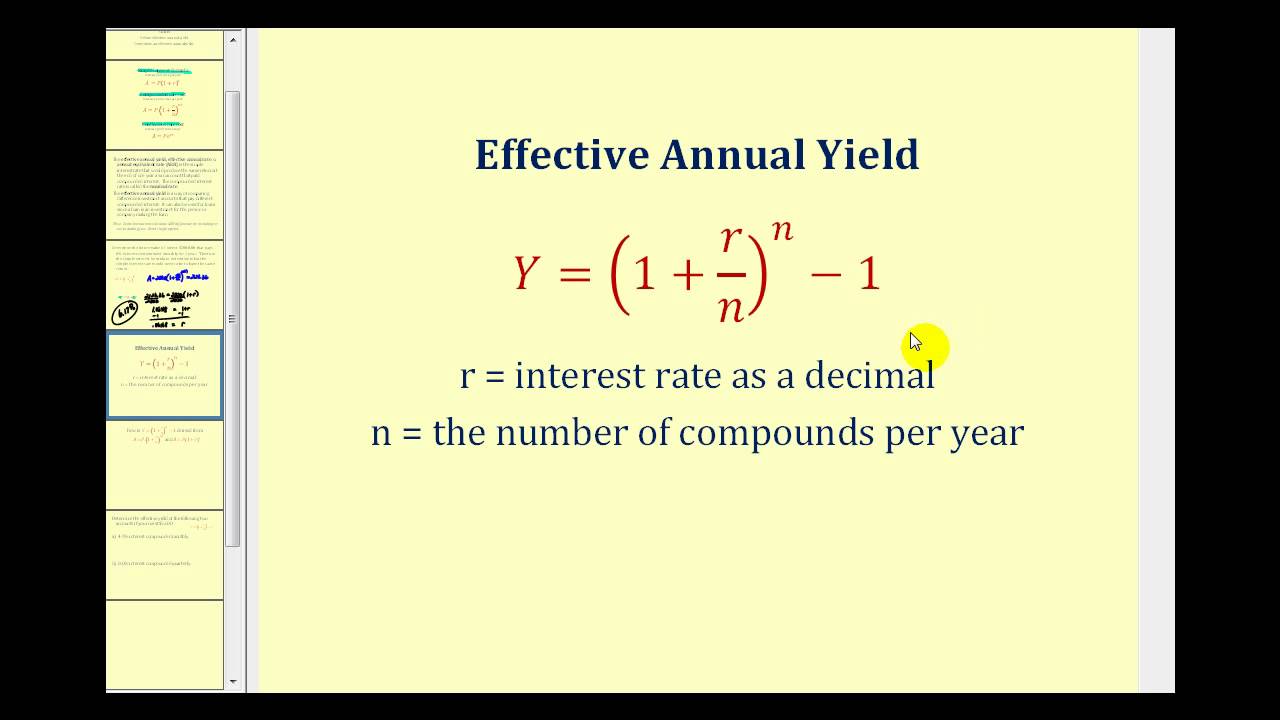

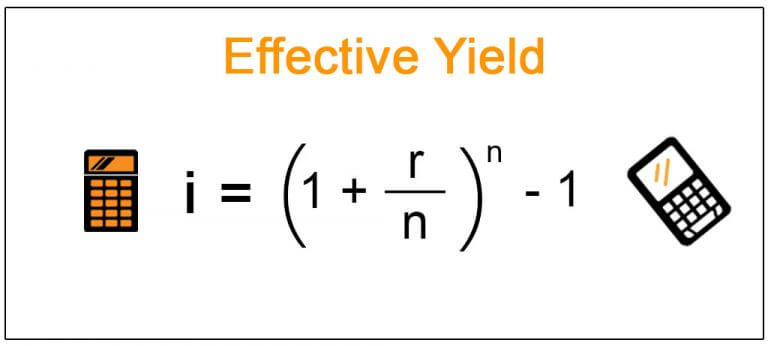

How to calculate coupon rate from yield. Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity... Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ... How to Calculate the Tax-Equivalent Yield Jun 07, 2021 · Let’s assume you’re in the 24% tax bracket in this example, and you're looking at a municipal bond that has a coupon, or interest rate, of 2.5%. You would perform the following calculation if you want to know the real rate of return on a nontaxable municipal bond—the rate that would be equivalent on a taxable bond. Effective Yield - Overview, Formula, Example, and Bond Equivalent Yield i - The nominal interest rate on the bond; n - The number of coupon payments received in each year; Practical Example. Assume that you purchase a bond with a nominal coupon rate of 7%. Coupon payments are received, as is common with many bonds, twice a year. Plugging in the calculation formula, you calculate the yield as follows:

How to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · To calculate the approximate yield to maturity, you need to know the coupon payment, the face value of the bond, the price paid for the bond and the number of years to maturity. ... Since we know that the coupon rate is 5 percent, we can start by plugging numbers that are higher than that into the formula above to solve for P. Remember, though ... Current Yield of a Bond - Meaning, Formula, How to Calculate? = Annual coupon payment / Current market price = 100/ 950 = 10.53%; Scenario #2: Premium bond Premium Bond A premium bond refers to a financial instrument that trades in the secondary market at a price exceeding its face value. This occurs when a bond’s coupon rate surpasses its prevailing market rate of interest. Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Bond Yield Formula | Step by Step Calculation & Examples Annual Coupon Payment = Face Value * Coupon Rate =$1300*6% Annual Coupon Payment =$78 Step 2: Calculation of bond yield Bond Yield = Annual Coupon Payment/Bond Price =$78/$1600 Bond Yield will be - =0.04875 we have considered in percentages by multiplying with 100's =0.048*100 Bond Yield =4.875%

Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link How to Calculate After Tax Yield: 11 Steps (with Pictures) May 06, 2021 · In order to compare the profitability of taxable and tax-free investments, it is very helpful to calculate the after tax yield on the taxable investments. 4. Increase your after tax yield over the long term. ... For example, with the 6% corporate bond and the 28.8 percent marginal tax rate, your after-tax yield would be calculated using the ... Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ...

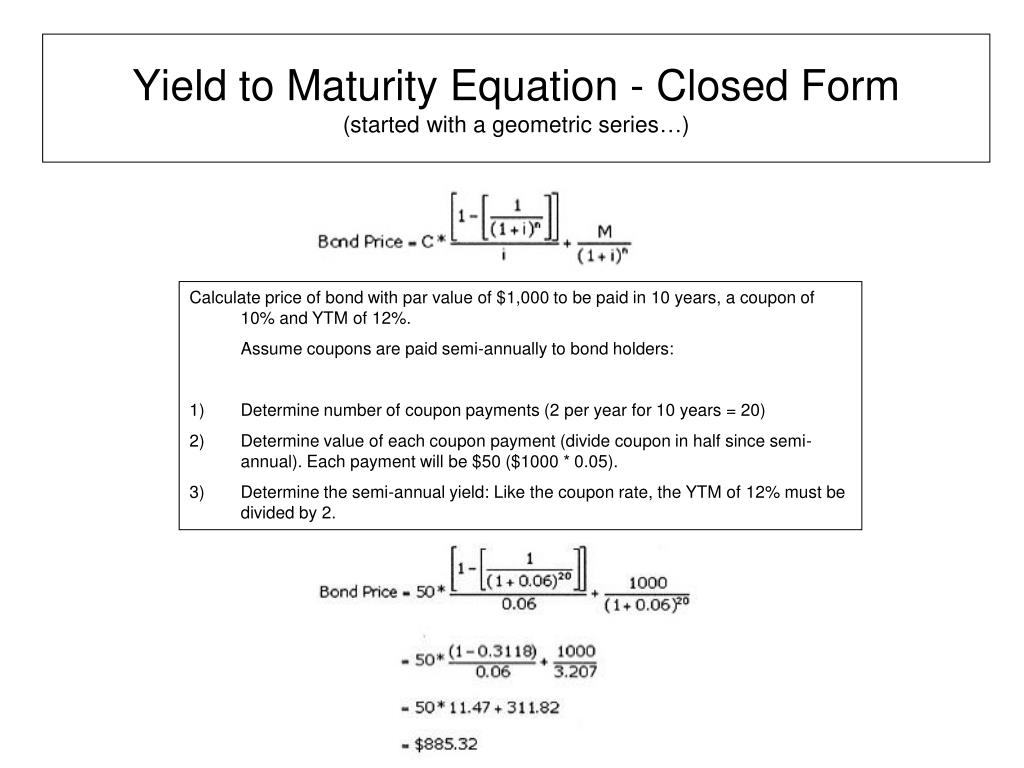

How to Calculate the Price of Coupon Bond? - WallStreetMojo The formula for coupon bond calculation can be done by using the following steps: Firstly, determine the par value of the bond issuance, and it is denoted by P. Next, determine the periodic coupon payment based on the coupon rate of the bond based, the frequency of the coupon payment, and the par value of the bond.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1%

How to Calculate Current Yield (Formula and Examples) Coupon rate = (total annual coupon payment / par value of bond) x 100. Example: A bond with a face value of $200 and a $5 coupon has a coupon rate of 2.5% because ($5 / $200) x 100 = 2.5%. Nominal yield vs. yield to maturity. Nominal yield is another name for the coupon rate. The yield to maturity is the total return you earn if you hold the ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

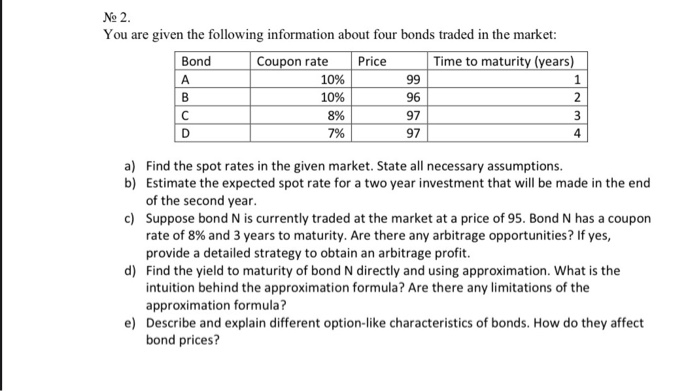

Bootstrapping | How to Construct a Zero Coupon Yield Curve in Excel? Zero-coupon rate for 2 year = 3.5% + (5% - 3.5%)* (2- 1)/ (3 - 1) = 3.5% + 0.75% Zero-Coupon Rate for 2 Years = 4.25% Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25% Conclusion The bootstrap examples give an insight into how zero rates are calculated for the pricing of bonds and other financial products.

What Is Coupon Rate and How Do You Calculate It? Coupon and yield rates are: Coupon Rate: 10%. This does not change. Investor A Yield Rate: 9%. The investor paid $1,100 for a bond that returns only $100 per year, making their yield on the bond lower than its coupon rate. Investor B Yield Rate: 11%. The investor got a good deal on this bond, collecting $100 per year in exchange for a $900 ...

How to Calculate the Yield of a Zero Coupon Bond Using Forward Rates? So we're gonna multiply 1.07 by the next term (1 + the forward rate) rate for year two. What's the forward rate for year two? It's 6.8%. So we're just taking (1 + the forward rate) for each of these periods. It's a five-year zero-coupon bond so we're gonna go all the way up to forward rate through year five.

Coupon Rate Definition - Investopedia Sep 05, 2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

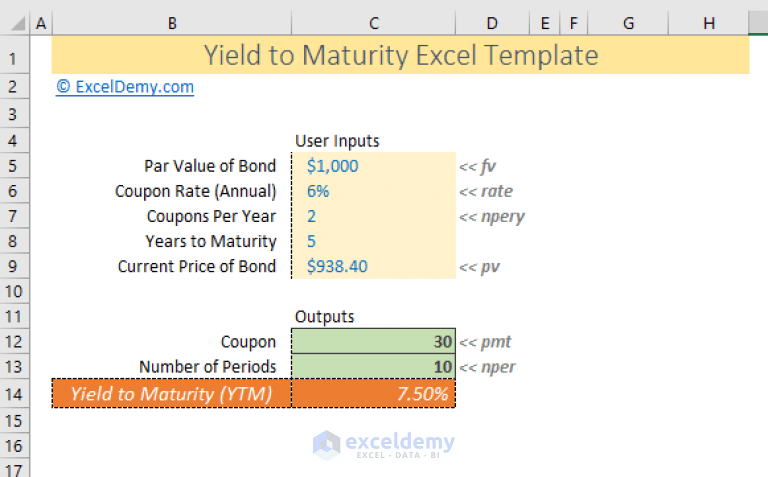

How to calculate yield to maturity in Excel (Free Excel Template) Sep 12, 2021 · How to Calculate Yield to Maturity (YTM) in Excel 1) Using the RATE Function. Suppose, you got an offer to invest in a bond. Here are the details of the bond: Par Value of Bond (Face Value, fv): $1000; Coupon Rate (Annual): 6%; Coupons Per Year (nper): 2. The company pays interest two times a year (semi-annually). Years to Maturity: 5 years.

Yield to Maturity vs. Coupon Rate: What's the Difference? To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for...

{POST}How Do You Calculate Effective Yield? [Comprehensive Answer] To calculate the current yield of a bond in Microsoft Excel, enter the bond value, the coupon rate, and the bond price into adjacent cells (e.g., A1 through A3). In cell A4, enter the formula "= A1 * A2 / A3" to render the current yield of the bond.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be -. Coupon Rate = 5-Year Treasury Yield + .05%. So if the 5-Year Treasury Yield is 7%, then the coupon rate for this security will be 7.5%. Now, if this coupon is revised every six months and after six months, the 5 ...

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator This calculator calculates the coupon rate using face value, coupon payment values.

How to Calculate Semi-Annual Bond Yield | The Motley Fool Nov 25, 2016 · To get an initial approximation of a semi-annual bond yield, one simple method is simply to take the coupon rate on the bond to calculate the semi-annual bond payment and then divide it by the ...

How do I Calculate Zero Coupon Bond Yield? (with picture) Zero coupon bond yield is calculated by using the present value equation and solving it for the discount rate. The resulting rate is the yield. It is both the discount rate that is revealed by the market situation and the return rate that investors expect from the bond. The zero coupon bond yield helps investors decide whether to invest in bonds.

How do you calculate yield to maturity on a t bill The Yield to maturity is the internal rate of return earned by an investor who bought the bond today at the market price, assuming that the bond will be held until maturity, and that all coupon and principal payments will be made on schedule. Yield to maturity (YTM) = [(Face value/Present value)1/Time period]-1.

Coupon vs Yield | Top 5 Differences (with Infographics) The way the coupon rate is calculated is by dividing the annual coupon payment by the face value of the bond. In this case, the coupon rate for the bond will be $40/$1000, which is a 4% annual rate. It can be paid quarterly, semi-annually, or yearly depending on the bond.

Post a Comment for "41 how to calculate coupon rate from yield"